Stonewell Bookkeeping Things To Know Before You Get This

Wiki Article

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Table of ContentsMore About Stonewell BookkeepingThe Stonewell Bookkeeping StatementsStonewell Bookkeeping - TruthsThe Main Principles Of Stonewell Bookkeeping Not known Details About Stonewell Bookkeeping

Here, we respond to the inquiry, exactly how does accounting assist a business? In a feeling, bookkeeping publications stand for a photo in time, yet just if they are upgraded commonly.

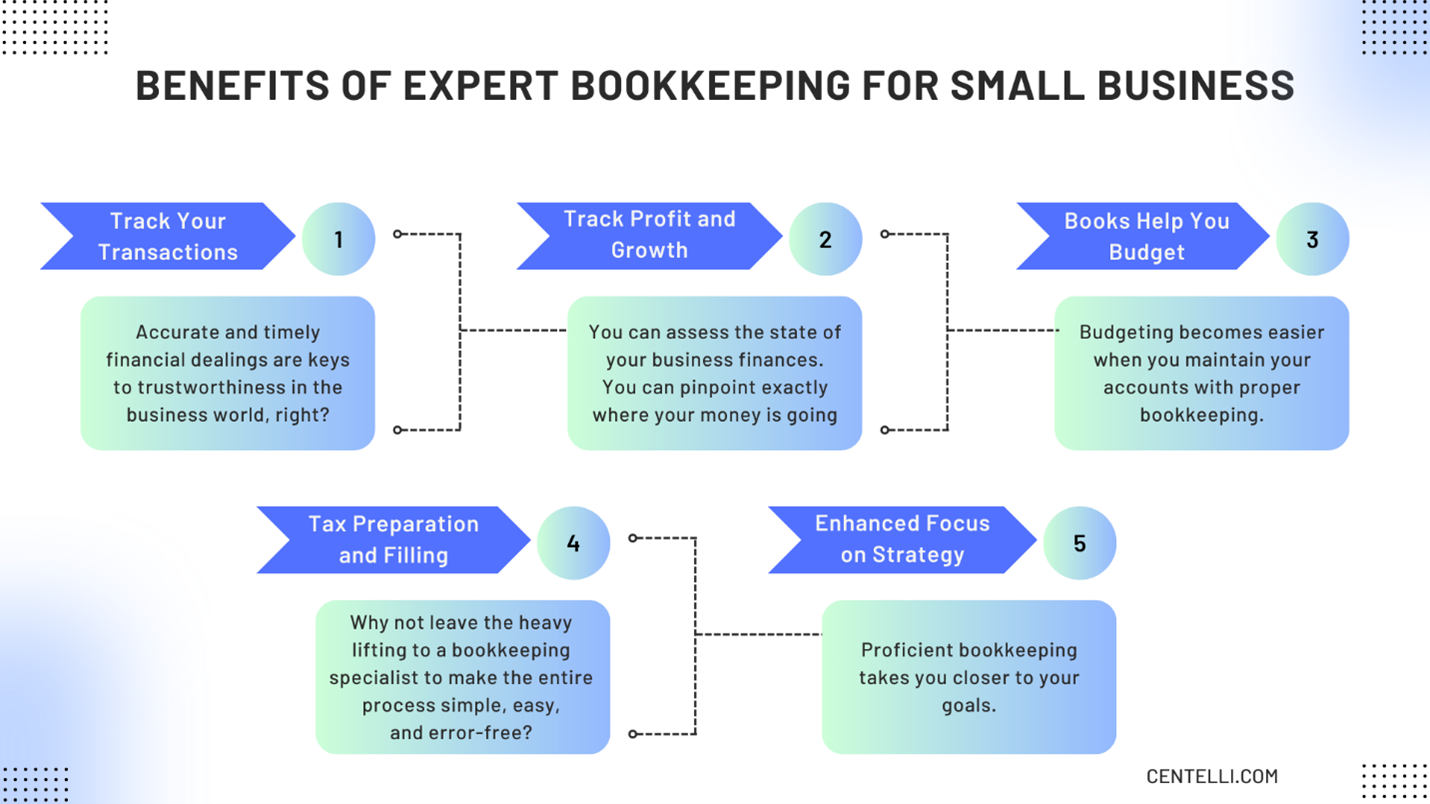

It can likewise resolve whether or not to raise its very own compensation from customers or customers. Nevertheless, none of these verdicts are made in a vacuum as factual numeric details should strengthen the financial decisions of every tiny organization. Such data is assembled via bookkeeping. Without an intimate understanding of the dynamics of your capital, every slow-paying customer, and quick-invoicing lender, becomes an event for anxiousness, and it can be a tedious and monotonous job.

You know the funds that are readily available and where they fall short. The news is not constantly excellent, yet at the very least you recognize it.

The Definitive Guide to Stonewell Bookkeeping

The puzzle of deductions, credit scores, exemptions, schedules, and, of training course, charges, is adequate to merely surrender to the IRS, without a body of efficient paperwork to support your cases. This is why a dedicated accountant is vital to a tiny service and is worth his/her weight in gold.

Your business return makes claims and depictions and the audit focuses on confirming them (https://gravatar.com/fullycolor4497c1f0dd). Great accounting is everything about attaching the dots in between those depictions and truth (small business bookkeeping services). When auditors can adhere to the details on a ledger to receipts, financial institution statements, and pay stubs, to call a few papers, they quickly find out of the proficiency and honesty of the business organization

Facts About Stonewell Bookkeeping Revealed

In the very same means, careless accounting contributes to stress and anxiousness, it likewise blinds company owner's to the possible they can understand over time. Without the information to see where you are, you are hard-pressed to set a location. Only with easy to understand, in-depth, and accurate information can a company owner or monitoring group plot a training course for future success.Business owners understand finest whether a bookkeeper, accountant, or both, is the ideal service. Both make crucial payments to a company, though they are not the same career. Whereas a bookkeeper can gather and arrange the information needed to support tax prep work, an accountant is better matched to prepare the return itself and really analyze the income statement.

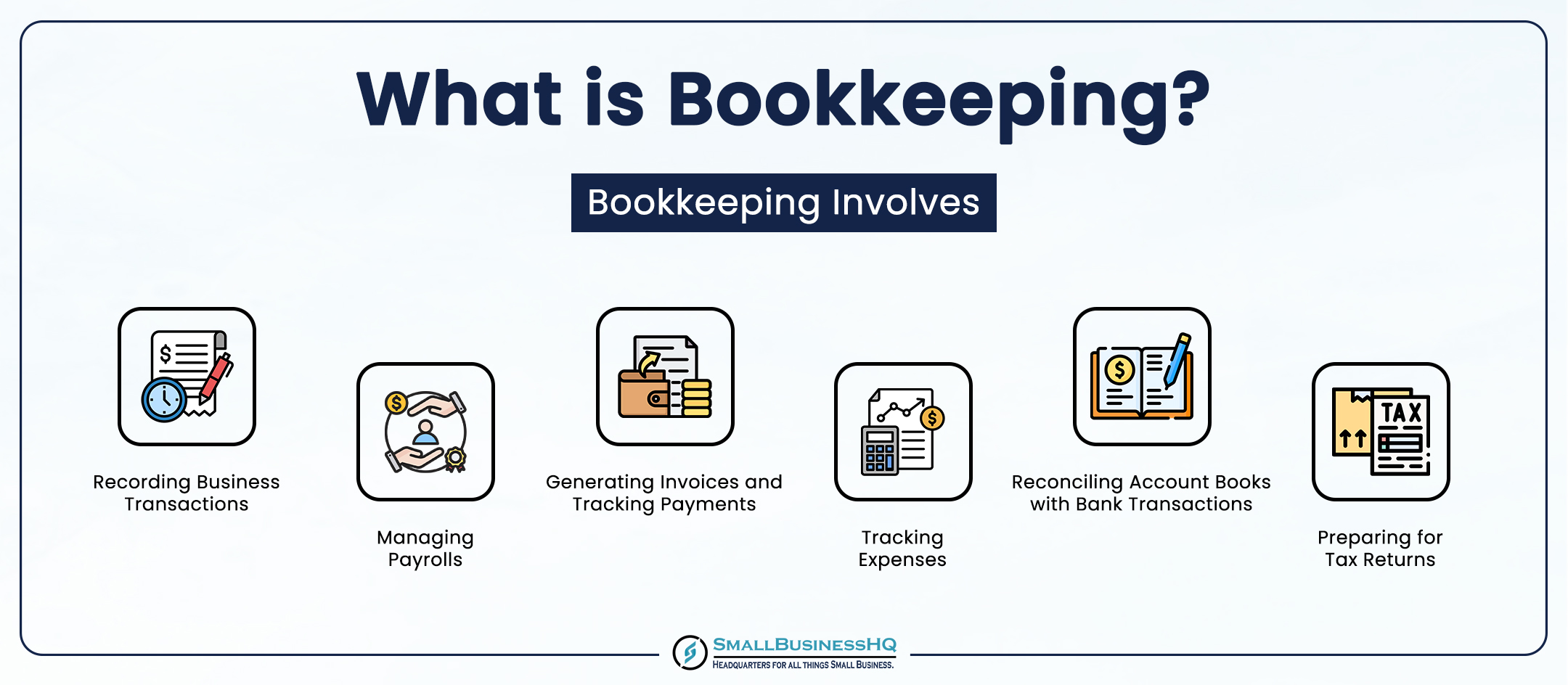

This write-up will delve into the, consisting of the and exactly how it can benefit your informative post company. Accounting entails recording and organizing monetary purchases, including sales, purchases, settlements, and receipts.

This write-up will delve into the, consisting of the and exactly how it can benefit your informative post company. Accounting entails recording and organizing monetary purchases, including sales, purchases, settlements, and receipts.By routinely updating economic records, accounting aids companies. Having all the economic details conveniently accessible keeps the tax authorities completely satisfied and protects against any type of last-minute frustration throughout tax obligation filings. Normal accounting ensures properly maintained and well organized records - https://profile.hatena.ne.jp/hirestonewell/profile. This aids in quickly r and saves services from the tension of looking for documents during deadlines (best franchises to own).

Everything about Stonewell Bookkeeping

They additionally want to understand what capacity the service has. These aspects can be quickly taken care of with bookkeeping.Hence, bookkeeping helps to prevent the hassles associated with reporting to investors. By keeping a close eye on monetary records, services can set realistic goals and track their development. This, consequently, promotes far better decision-making and faster business growth. Federal government guidelines typically need companies to keep financial documents. Regular accounting ensures that businesses remain certified and prevent any kind of penalties or lawful issues.

Single-entry accounting is easy and works finest for little services with few purchases. It does not track properties and obligations, making it less extensive contrasted to double-entry bookkeeping.

What Does Stonewell Bookkeeping Do?

This can be daily, weekly, or monthly, relying on your business's size and the quantity of deals. Don't hesitate to seek help from an accounting professional or accountant if you locate handling your monetary records challenging. If you are trying to find a complimentary walkthrough with the Accountancy Option by KPI, contact us today.Report this wiki page